On a BUY Day, we should expect a DECLINE from the HIGH of the SELL SHORT Day to the LOW of the Buy

Day.

If the HIGH of the SELL SHORT Day was made LAST then the DECLINE should happen on the BUY Day with a

70% chance of making the LOW LAST. However if the HIGH was made FIRST on the SELL SHORT Day, then

part or all of the DECLINE was already done and should continue on the BUY Day.

Our TTT E-book gives us an idea where the LOW should be and when used in conjunction with other indicators

or systems like MTPredictor to confirm the LOW, then LONG positions may be considered.

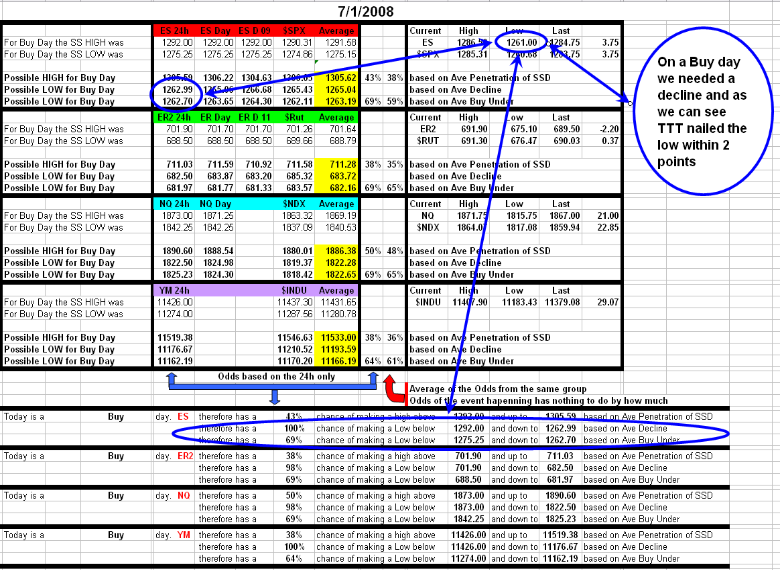

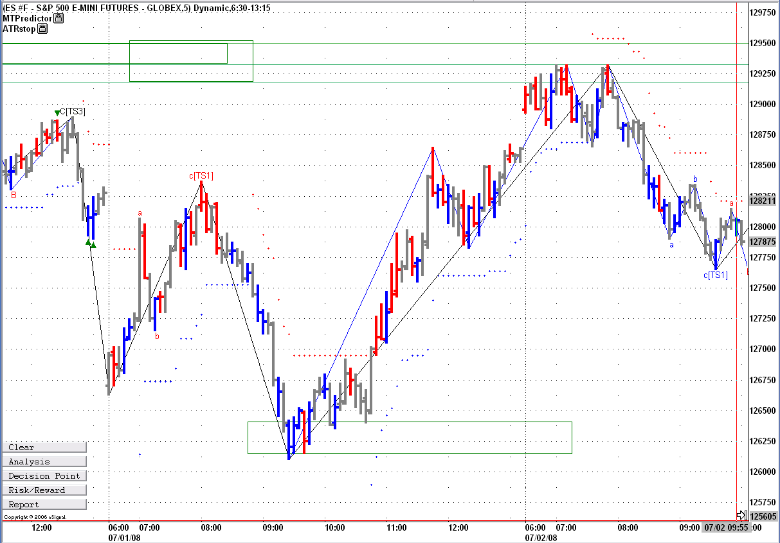

Here is a perfect example of the TTT report we had before the start of the trading day. We expected the LOW to

come in around 1262 level. The market gapped down at the open and, as you can see, the LOW was made at

1261.00. We can also see on the chart below that 1261 was right in the MTPredictor Decision Point box. The

market then reversed and climbed 25 points. That was a perfect trade with very low risk and great reward.

Day.

If the HIGH of the SELL SHORT Day was made LAST then the DECLINE should happen on the BUY Day with a

70% chance of making the LOW LAST. However if the HIGH was made FIRST on the SELL SHORT Day, then

part or all of the DECLINE was already done and should continue on the BUY Day.

Our TTT E-book gives us an idea where the LOW should be and when used in conjunction with other indicators

or systems like MTPredictor to confirm the LOW, then LONG positions may be considered.

Here is a perfect example of the TTT report we had before the start of the trading day. We expected the LOW to

come in around 1262 level. The market gapped down at the open and, as you can see, the LOW was made at

1261.00. We can also see on the chart below that 1261 was right in the MTPredictor Decision Point box. The

market then reversed and climbed 25 points. That was a perfect trade with very low risk and great reward.

| The Buy Day |

| Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results. see Risk Disclosure |

Taylor Trading Technique Services

| Current Electronic Version of Taylor's 1950 "Book Method" |

| T |

| T |

T

E-books

Follow us on Twitter @ https://twitter.com/trading_taylor